The American dream of owning a home has been a cornerstone of our national identity for generations. It’s a symbol of stability, success, and putting down roots. But let’s face it – in today’s housing market, that dream can feel more like a far-off fantasy for many.

Sky-high prices, stringent lending requirements, and the need for substantial down payments have left many would-be homeowners feeling stuck on the sidelines.

Enter the concept of rent to own homes. This alternative path to homeownership is gaining traction across the USA, offering a glimmer of hope to those who thought their dream home was out of reach. It’s not just a trend – it’s a potential game-changer in the world of real estate.

In this comprehensive guide, we’ll explore every nook and cranny of the rent to own home landscape. Whether you’re a curious first-time homebuyer, a seller looking for creative options, or just someone trying to understand the ever-evolving housing market, you’re in the right place.

So, grab a cup of coffee, get comfortable, and let’s embark on this journey through the world of rent to own homes.

What Are Rent to Own Homes?

At its core, a rent to own home agreement is like taking a test drive of homeownership. It’s a unique hybrid that combines elements of renting and buying, giving potential homeowners a chance to ease into ownership over time.

Here’s the basic concept:

- You rent a home for a set period (usually 1-3 years)

- During this time, you have the exclusive option to buy the home

- A portion of your rent payments may go towards the future purchase price

It’s important to note that rent to own homes aren’t a new invention. They’ve been around in various forms for decades, but they’ve gained renewed interest in recent years as traditional paths to homeownership have become more challenging for many Americans.

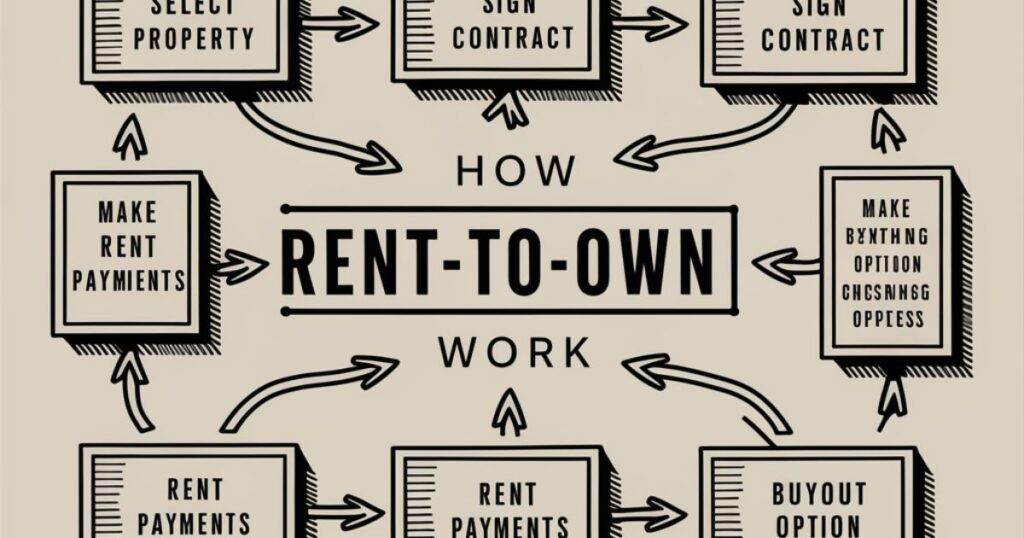

How Rent to Own Homes Work

Let’s break down the nuts and bolts of how rent to own homes typically function in the USA:

The Agreement Structure: It all starts with a legally binding contract between the potential buyer (that’s you) and the property owner. This agreement outlines all the terms and conditions of the arrangement.

Option Fees: You’ll usually pay an upfront “option fee” to secure your right to buy the home in the future. Think of it as a deposit on your dream home. This fee is typically 1-5% of the agreed-upon purchase price.

Rent Premium: Your monthly rent might be slightly higher than the market rate. The extra amount (known as the rent premium) often goes towards your future down payment or purchase price.

Purchase Price Determination: The future purchase price is typically agreed upon at the start of the lease. It might be based on the current market value or a projected future value.

Lease Duration: In the USA, these agreements commonly last 1-3 years, giving you time to prepare for homeownership.

Here’s a quick comparison table to illustrate the differences:

| Feature | Traditional Renting | Rent to Own | Traditional Buying |

| Upfront Costs | Security Deposit | Option Fee | Down Payment |

| Monthly Payment | Rent Only | Rent + Premium | Mortgage Payment |

| Maintenance | Landlord’s Responsibility | Varies by Agreement | Homeowner’s Responsibility |

| Equity Building | No | Possible | Yes |

| Future Purchase Option | No | Yes | N/A (Already Purchased) |

Benefits of Rent to Own Homes

For Potential Buyers

- Time to Improve Credit Scores: If your credit isn’t quite where it needs to be for a traditional mortgage, a rent to own agreement gives you time to polish it up. Use this period to pay down debts and establish a solid payment history.

- Opportunity to Save for a Down Payment: That rent premium we mentioned earlier? It’s like a forced savings plan for your future home purchase. By the end of your lease, you could have a tidy sum saved up.

- Test-Driving Homeownership: Not sure if you’re ready for the full commitment of homeownership? Rent to own lets you experience the neighborhood, the home itself, and some of the responsibilities of owning before you take the plunge.

“Rent to own gave us the chance to live in our dream neighborhood while we got our finances in order. It was the stepping stone we needed to become homeowners.” – Sarah and Mike, first-time homebuyers in Denver

For Sellers

- Expanded Pool of Potential Buyers: In a tough market, rent to own agreements can attract buyers who might not qualify for traditional financing right away.

- Steady Income During the Lease Period: As a seller, you’ll enjoy a consistent rental income stream while working towards a final sale.

- Potential for Higher Sale Price: By agreeing to a future purchase price now, you might be able to lock in a higher price than the current market value.

Read this Post: CANDY MONTGOMERY: HOUSE IN WYLIE, 43 YEARS LATER

Potential Risks and Drawbacks of Rent to Own Homes

While rent to own homes can offer a path to homeownership, they’re not without their potential pitfalls. Let’s take a clear-eyed look at some of the risks:

For Buyers

- Non-refundable Option Fees: That upfront fee you pay? It’s usually non-refundable. If you decide not to buy or can’t secure financing, you could lose that investment.

- Overpricing in a Changing Market: If home values drop during your lease period, you might be locked into a purchase price that’s higher than the home’s current value.

- Maintenance Responsibilities: Depending on your agreement, you might be responsible for repairs and maintenance before you even own the home.

For Sellers

- Tied-up Property: Your property is off the market during the lease period, potentially missing out on other interested buyers.

- Buyer’s Potential Default: If the buyer can’t follow through on the purchase, you’ll need to start the selling process all over again.

- Market Value Increases: If property values skyrocket during the lease period, you might miss out on potential profits.

Legal Considerations for Rent to Own Homes in the USA

Navigating the legal landscape of rent to own homes can be tricky, as regulations can vary significantly from state to state. Here are some key points to keep in mind:

- State-specific Regulations: Some states have specific laws governing rent to own agreements. For example, in California, these agreements must be in writing and include specific disclosures.

- Essential Contract Elements: A solid rent to own agreement should clearly outline:

- The option fee amount

- The purchase price or how it will be determined

- The portion of rent that will be credited towards the purchase

- The deadline for exercising the purchase option

- Responsibilities for maintenance, property taxes, and insurance

- Professional Legal Advice: Given the complexity and potential long-term implications of these agreements, it’s crucial to have a real estate attorney review any contract before you sign.

“I always advise my clients to treat a rent to own agreement with the same seriousness as a traditional home purchase. The stakes are just as high.” – Jennifer Lopez, Real Estate Attorney in Chicago

Tips for Success with Rent to Own Homes

For Buyers

- Thorough Property Inspection: Don’t skip this step! A professional inspection can reveal potential issues that could affect your decision to purchase down the line.

- Understanding the Local Real Estate Market: Research home values and trends in the area. This knowledge will help you determine if the agreed-upon purchase price is fair.

- Financial Preparation: Use the lease period to actively improve your credit score and save for additional down payment funds. Consider working with a financial advisor to create a solid plan.

For Sellers

- Proper Tenant Screening: Since your tenant may become the future owner, it’s crucial to thoroughly vet potential buyers. Check credit scores, employment history, and references.

- Clear Communication of Terms: Ensure all aspects of the agreement are clearly explained and understood by both parties to avoid future disputes.

- Consideration of Long-term Implications: Think carefully about how this agreement fits into your overall financial and real estate goals.

Alternatives to Rent to Own Homes

While rent to own can be a great option, it’s not the only path to homeownership. Consider these alternatives:

- Traditional Mortgages: If you have good credit and a stable income, a conventional mortgage might be within reach.

- FHA Loans: These government-backed loans often have more lenient credit requirements and lower down payment options.

- Lease Options: Similar to rent to own, but typically with less commitment and lower fees.

- Owner Financing: The seller acts as the lender, potentially offering more flexible terms than traditional banks.

Real-Life Success Stories: Rent to Own Homes in Action

Case Study 1: The Johnsons – First-time Homebuyers in Suburban America

The Johnsons, a young couple in their late 20s, had been renting an apartment in a bustling suburb of Atlanta. They dreamed of owning a home but struggled to save for a down payment while paying high rent.

They discovered a rent to own opportunity in a nearby family-friendly neighborhood. The 3-bedroom house was perfect for their plans to start a family. Here’s how it worked out for them:

- Option Fee: $5,000 (2% of the $250,000 purchase price)

- Monthly Rent: $1,800 ($300 above market rate)

- Lease Term: 2 years

- Purchase Price: $250,000 (locked in at the start of the agreement)

During the two-year lease, the Johnsons paid $7,200 in rent premiums ($300 x 24 months), which was credited towards their down payment. They also used this time to improve their credit scores and save additional funds.

At the end of the lease, they were able to secure a conventional mortgage and complete the purchase. The $5,000 option fee and $7,200 in rent premiums gave them a significant head start on their down payment.

Case Study 2: The Garcias – Upgrading in a Competitive Urban Market

The Garcia family had outgrown their small condo in downtown San Francisco. They wanted to upgrade to a single-family home but were priced out of their desired neighborhood.

A rent to own agreement allowed them to move into their dream home while they built up additional equity in their condo. Here’s how their agreement looked:

- Option Fee: $20,000 (2% of the $1,000,000 purchase price)

- Monthly Rent: $4,500 ($500 above market rate)

- Lease Term: 3 years

- Purchase Price: $1,000,000 (with an agreement to reassess based on market value at the end of the lease)

During the lease period, the Garcias were able to sell their condo at a profit, adding to their down payment fund. They also benefited from $18,000 in rent premiums ($500 x 36 months) credited towards their purchase.

Although the market value of the home increased to $1,100,000 by the end of the lease, the Garcias were able to purchase at the originally agreed price of $1,000,000, instantly gaining $100,000 in equity.

Is a Rent to Own Home Right for You?

Deciding whether a rent to own home is the right choice depends on your unique situation. Here are some factors to consider:

- Assess Your Financial Situation:

- Credit Score: If it needs improvement, rent to own could give you time to boost it.

- Savings: Do you need time to build up a down payment?

- Income Stability: Are you confident in your ability to make payments over the long term?

- Evaluate Your Long-term Housing Goals:

- Are you committed to staying in the same area for several years?

- Does the home meet your future needs (size, location, etc.)?

- Weigh the Pros and Cons:

- Pros: Time to improve finances, locked-in purchase price, chance to “try before you buy”

- Cons: Higher monthly payments, potential for lost investment if you don’t buy

Conclusion: The Future of Rent to Own in the USA Housing Market

As we’ve explored, rent to own homes offer a unique path to homeownership that can bridge the gap for many aspiring homeowners. They provide flexibility, time to improve financial standing, and a chance to ease into the responsibilities of homeownership.

However, they’re not without risks and complexities. It’s crucial to approach any rent to own agreement with a clear understanding of the terms, your rights, and your responsibilities.

Looking ahead, we may see rent to own agreements become increasingly common in the USA housing market. As traditional paths to homeownership remain challenging for many, alternative options like rent to own could play a significant role in helping more Americans achieve their dream of owning a home.

If you’re considering a rent to own home, take the time to do your research, consult with professionals, and carefully consider your long-term goals. With the right approach, a rent to own agreement could be your stepping stone to homeownership.

Remember, the journey to homeownership isn’t always a straight line. Whether it’s through a rent to own agreement or another path, the key is to stay informed, be patient, and keep working towards your goal. Your future home might be closer than you think!

FAQ’s About Rent to Own Homes

How long do rent to own agreements typically last?

In the USA, most rent to own agreements last between 1-3 years, but the exact duration can be negotiated between the buyer and seller.

Can I back out of a rent to own agreement?

Yes, typically you can choose not to purchase the home at the end of the lease. However, you may forfeit any option fees or rent premiums you’ve paid.

What happens if I can’t secure a mortgage at the end of the lease?

If you’re unable to secure financing, you may lose the option to purchase the home. It’s crucial to work on your creditworthiness throughout the lease period.

Are rent to own homes more expensive than traditional purchases?

They can be, due to potentially higher monthly payments and non-refundable option fees. However, they also offer unique benefits that may outweigh the costs for some buyers.

How can I find rent to own homes in my area?

Look for real estate agents who specialize in rent to own properties, check online real estate listings, or consider working with a company that focuses on rent to own agreements.